Vomitoxin in the Corn: Call your agent or office immediately if you discover vitomoxin in your corn. If hauling directly to town, be sure to have the elevator hold a sample if the load has vomitoxin with level 5.1 parts per million or higher. A notice of loss must be submitted to be eligible for a quality loss. Elevator samples must be picked up by an adjuster.

Our News & Events

Succession Planning for Your Farm

Finding the time to talk with your family about succession planning for your farm can be difficult. You may also feel uncomfortable just thinking about selling your farm or delegating control to members of your family.

What You Should Know in Advance About Succession Planning for Your Farm

Take time to develop an efficient transition plan for your agricultural businesses. You will help ensure that your family’s wishes are met and minimize emotional stress.

A succession plan may include:

- The transfer or sale of property to a member of the designated family. To be fair to heirs not related to the farm, you can leave them equal shares of money, stocks or other assets.

- The liquidation of assets of the farm, such as auction equipment and livestock, or the sale of land.

- The rental or lease of land or equipment.

- The sale or leasing of property.

Determine the Desired Result

Concentrate on the desired results of the succession. Among all the important questions, you should ask yourself:

- What future do we visualize with my spouse for the farm?

- Do I want to participate with smaller-scale operations?

- What kind of income would I need to retire or for healthcare costs?

If any member of your family wanted and could take over operations, you can relax because that person has the knowledge and ability to operate the farm profitably.

Ethical Wills

An ethical will is created from the values and core beliefs that grow a family. Creating an ethical will is free, useful, and straightforward. In one or two pages you can explain how you envision the future of your farm and your family’s participation in succession planning for your farm. It acts as a road map for your heirs, showing them a path to success and happiness on the farm.

Ward off Failure

To ensure the continued success of your farm, it’s essential to take preventive measures to ward off failure. Always take into account the following risks:

- Inadequate cash flow

- Settlement of some assets for retirement

- Leaving the farm to someone unreliable or not ready and willing to lead or manage the farm

It is important to include the help of qualified professionals who have no interest in final decisions. They can help you make accurate and objective decisions for your farm’s succession. Among the qualified professionals we can include:

- A wealth or financial advisor who specializes in planning farm succession

- A moderator or referee to help with family discussions

- A bank that helps with financial resources

- Your accountant, who has the income records and projections of your business

- Your personal lawyer, or one who specializes in tax issues

- Your farm insurance agency

We want to help you make the best decisions for your farm and your family, now and in the future. Call us, Wathen Insurance, at 765-676-9666, and we can discuss the necessity of crop insurance in your succession plan. Protect the farm every year with crop insurance.

How to Improve Relationships on the Farm

We love our partners and appreciate the connection with them and our time with the family, but farmers and farming families lead hectic lives. We’re flooded by technology, and we are constantly connected to the things that happen outside our home. That goes for farming families, too. And, because there is often no separation between work and home on the farm, it pays to constantly work to improve relationships, especially in a farm family.

Unfortunately, it is very easy to lose touch with our most valuable relationships as we quickly respond to another email, send a text to a friend, publish a quick update on Facebook, or entertain ourselves on Netflix.

The good news is that there are many easy ways to improve relationships and develop lasting emotional connections with our spouse and children. Working with your significant other can be a dream come true. However, if it’s become a chore, we have some great tips to improve your relationships on the farm.

Tips to Improve Relationships on the Farm

Listen. To keep a healthy relationship with a spouse or children, listen to them. If you’ve had a long day and want nothing more than a quiet, relaxing evening, simply open your ears. Sometimes it’s enough to let them know you are there, and you hear what they are saying. Accept them and witness their emotions.

Share. Share quality leisure time with them regularly. Reserve a space to devote that time alone to them, away from distractions, mobile and social networks, and give them your full attention. You could take the kids to get ice cream and to the park. You could take your significant other to see a movie and out to dinner.

Focus on yourself. Pay attention to your feelings. Instead of using your free time on social networks constantly, stay away from the phone and screens for 30 minutes a day to reconnect with yourself. Try meditation, reading magazines, painting, writing stories, yoga, or a nature walk.

Take some time each day to let your thoughts and worries leave, to purposely get away from the screens and get in touch with who you really are. This practice will help you to find yourself and in turn dedicate more time and attention to your family so you can improve relationships on the farm.

Open your eyes. Maintain eye contact with your children and spouse. Farming is a 24/7 job, and sometimes you may feel like you don’t even have time to stop and look at your family. To improve relationships on the farm, slow down and open your eyes. Develop a daily routine that offers you the time to stop, take a breath, and look your partner in the eye. Whenever you can, every time you talk to them, remember to make eye contact. This helps build a connection and maintain it over time.

Talk. Tell them more about your life. The children want to know what it was like for you to do the things they are learning to do now. Tell them as many stories as you can about your own childhood and adolescence. Here are some things they would love to hear about:

- their grandparents

- when you learned to ride a bicycle

- when you fell in love for the first time and with who

- who went with you to your first dance

- where you were going on vacation with your family

- the books you’ve read

- what did you like most as a child or what were your friends like?

All these details help them feel closer to you and make decisions in their own lives.

You can also surprise a partner by sharing something about yourself that they don’t know.

At Wathen Insurance, we’re here for your crop and hail insurance needs, so you have more time to focus on the important things. We’ll prove you the security and support you need so the next time you take your spouse on a date, you won’t need to worry about work. Give us a call at 765-676-9666 to talk about what we can do for you.

There are many ways to improve relationships on the farm. What kinds of things would you add to this list?

The Benefits of Raising Farm Animals for Kids

If you aren’t already familiar with 4H and FFA, they are programs designed to give children and teenagers hands-on experience with livestock, agriculture, and general country and life skills. For people who value heritage, hard work, and enrichment, these programs offer their children valuable life experience that they might not get anywhere else. Raising farm animals requires many things, including commitment and a variety of important skills.

In addition to people that don’t live on farms or ranches, farm families encourage their children to take part in 4H and FFA. They can engage with these life lessons in a secure, social environment that is familiar and comfortable. If you’re considering enrolling your child on one of these programs, here is some information on how raising farm animals for 4H and FFA can teach young people important lessons.

Learning Animal Care & Handling

Whether a child is growing up on a farm or living in the suburbs, knowing how to handle large and small farm animals is a valuable skill. Sheep, horses, and cattle can be bigger than adults, and definitely larger than children. Raising rabbits and poultry is different than caring for a household pet.

The discipline and knowledge that they learn in 4H and FFA allows them to interact with farm animals in a safe way, preparing them for any future interactions. In a way, this hands-on experience is insurance for their futures. If they ever come across a cow, sheep, horse, or chicken in the future, they’ll know how to avoid injury.

Along with encouraging better safety, they also learn the importance of caring for farm animals. From vaccinations to feeding, they’re present for many parts of the animals’ lives. If they decide to pursue futures with animals, this experience can spark inspiration and give them the knowledge they need to succeed.

Encouraging Confidence & Responsibility

Children need opportunities to prove their skills — not just to their parents and peers, but to themselves. Given a chance to interact with another living thing, children learn to care for that creature and help it grow up. This gives them the confidence to handle other responsibilities that come their way.

The daily chores to properly care for farm animals encourage discipline and having responsibility for another life gives them training for any future pets or livestock they might care for. In the long run, it might even prepare them for having children or managing a business.

When they do work for 4H or FFA, they are given responsibility and guided in the right direction. They make the decisions and do the work. This can encourage them to take responsibility for themselves and their animals and do their best to succeed.

Saying Goodbye

Once show season is done and their animal is ready to leave, it’s time to say goodbye. Many children care for these farm animals, only to see them go to the market for profit. From there, they manage the money they earn off these animals.

While this is the nature of the livestock business, the act of saying goodbye is an important lesson for many children. Doing hard work and establishing bonds with an animal, only to see if leave can be hard. However, moving on and becoming inspired for the next project is part of the learning experience.

Regardless of what a young person decides to do in adulthood, this lesson is an important one.

Going Further

Programs like 4H and FFA are designed for a specific purpose: to encourage children and ensure their futures. If your child enjoys 4H and FFA, or has an interest in entering the agriculture field, you can help them learn about other aspects of the trade, including insurance and how it helps them.

If you’re interested in talking to your teen about agriculture insurance and how it might benefit their future farms, contact us.

Wathen Insurance is dedicated to helping the people that feed and support the nation, and offer a number of programs to ensure that they have full coverage. It’s never too early to begin preparing your future farmer, so why not start by teaching them about other aspects of managing all the demands of a successful operation?

Prevented Planting

We know it has been a wet spring, and with that thought in mind, we wanted to provide the answers for our clients to some frequently asked questions regarding crops with prevented planting coverage.

Client FAQs

- There are pretty strict limitations on PP acreage as far as trying to get other value out of those acres. If you want to preserve your full PP payment, it’s black dirt or cover crop only.

- If you plant a second crop during the LPP of the PP crop there is NO PP payment.

- If you plant a second crop after the LPP of the PP crop, the PP payment is reduced to 35% of what it would have been. Exceptions to this rule may apply for producers in a double crop area, who have a history of double cropping.

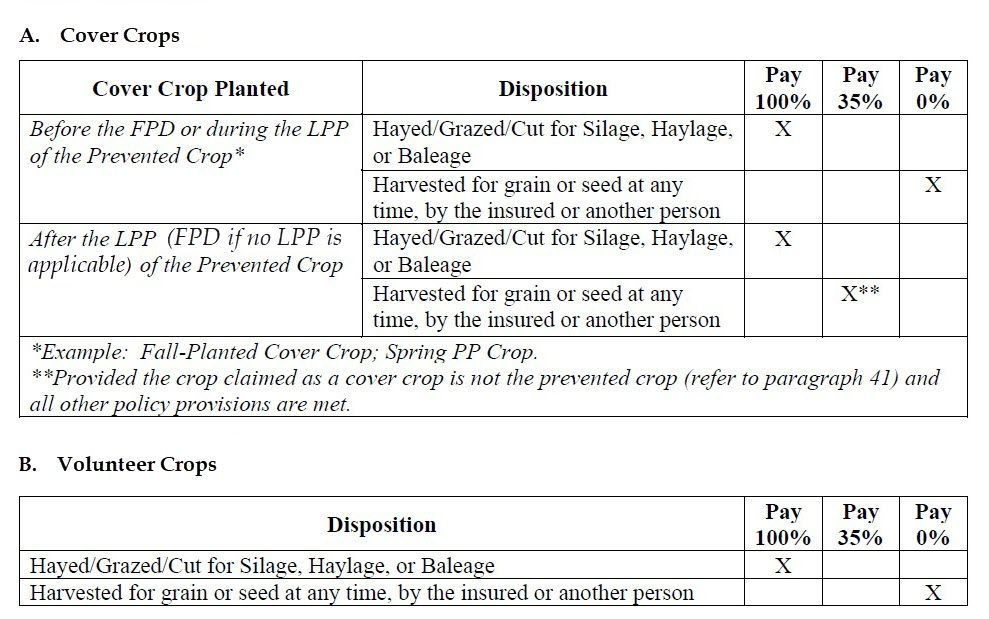

Can I plant a cover crop on the PP acres?

Cover crops may be planted and may be hayed, grazed, cut for silage, haylage, or baleage at any time without impacting the PP payment. However, cover crops cannot be harvested for grain or seed without impacting any potential PP payment. Please note that Corn will not be considered a cover crop on PP acreage. See table below to see how cover crops or volunteer crops may impact PP payments.

Can I rent my PP acreage to my neighbor who wants to plant a cover crop to hay/graze/cut for silage, haylage, or baleage?

Yes. Beginning with 2022 spring crops, it’s now okay to rent to your neighbor for those purposes. Keep in mind, though, that they cannot harvest for grain or seed without impacting any PP payment.

Will my APH database be impacted when I claim and qualify for a PP payment?

The APH database will suffer a yield reduction, but only on acreage where the payment was reduced to 35% because a second crop was planted. Those are the only PP acres that will show in the database and the yield they receive is 60% of the approved yield. PP acreage paid at 100% of the PP guarantee does not impact the APH database at all.

The Back 40 Call

Join the monthly webinar for insider ADM marketing insights on the 4th Tuesday of every month and an opportunity for Question & Answer with ADM Crop Risk Specialists.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Rotational Grazing and Regenerative Agriculture

A small pasture-based farm located in southwestern Wisconsin is making a big splash with its products and unusual ways of cultivating crops and raising livestock. Unconventional Acres prioritizes sustainability, rotational grazing techniques, improving land health,...

Farm Bill Programs

2021 Information

2022 updates coming soon!

Our Story

The Wathen Family Agency

Wathen Insurance was started in the fall of 1982 by Tom and Joyce Wathen. While running a corn and soybean farming operation themselves, the opportunity to help other producers with their risk management decisions was very intriguing and appealing to Tom and Joyce. With a great deal of Passion and genuine interest in their policyholders the Wathen agency grew beyond their expectations, which provided the next generation of the Wathen’s an opportunity to join the business.

Keeping the business in the family provides for excellent quality control while affording attention to detail. We look forward to providing personalized service for our customers in the pursuit of continued success and who knows maybe our next generation will build upon what we started. Thanking you all for our continued success and wishing you a most prosperous year!

Federal Programs

Margin Protection Program

Margin Protection is a crop insurance coverage option that provides producers with coverage against an unexpected decrease in their operating margin caused by: Reduced county yields Reduced commodity prices Increased price of selected inputs Any combination of the…

PRF Program

PASTURE, RANGELAND, FORAGE The Risk Management Agency (RMA) Pasture, Rangeland, and Forage (PRF) Pilot Insurance Program is designed to provide insurance coverage on your perennial pasture, rangeland, or forage acres. This innovative pilot program is based on…

Area Yield Protection

Area Yield Protection (AYP) is designed as a risk management tool to insure against widespread loss of production of the insured crop in a county. AYP is primarily intended for use by those producers whose farm yield tend to follow the average County Yield. AYP is…

Area Revenue Protection

Area Revenue Protection covers against loss of yield due to county production loss and loss of revenue due to a county level production loss, price decline, or combination of both.

Yield Protection

Yield Protection (YP) and Actual Production History (APH) are multiple-peril crop insurance products that provide protection against losses in yield due to nearly all natural disasters.

Revenue Protection

Revenue Protection (RP) and Revenue Protection with Harvest Price Exclusion (RPHPE) are multiple-peril crop insurance products that are based on the Commodity Exchange Price Provisions (CEPP) prices and protects against production loss, price decline or increase, or a combination of both.

Supplemental Coverage Option

The Supplemental Coverage Option (SCO) is a county-level revenue-based or yield-based optional endorsement that covers a portion of losses not covered by the same crop’s underlying crop insurance policy.

Enhanced Coverage Option

Similar to the Supplemental Coverage Option (SCO), the Enhanced Coverage Option (ECO) is a new crop insurance option that provides additional area-based coverage for a portion of the underlying crop insurance policy deductible.

Livestock Risk Protection (LRP)

Livestock Risk Protection is designed to protect against declining market prices. A variety of coverage levels and insurance periods are offered that match the time the livestock would normally be marketed.

Livestock Gross Margin (LGM)

Livestock Gross Margin Insurance provides protection against the loss of gross margin (market value of livestock, or livestock products, minus feed costs). LGM uses futures prices to determine the expected gross margin and the actual gross margin. The price a producer actually receives at market is not used in these calculations.

Private Programs

Wind

Wind with Extra Harvest Allowance is an optional Crop Hail endorsement that provides coverage for wind, green snap, and extra harvest expense for corn that has blown down due to wind damage. It covers ears that cannot be recovered because of flattening, bending, or breaking of the stalk.

Band Coverage

At its core, BAND Coverage is a risk management tool that protects against shallow losses and provides reliable input cost recovery. A lower deductible translates to a higher trigger for the producer’s indemnity, providing support exactly when it is needed.

Revenue Boost

Revenue Boost is a supplemental policy that pairs with most MPCI plans to provide higher coverage and protection to insureds. Want to protect more margin and build a stronger risk management plan? Ask your agent today about Revenue Boost.

Wathen Insurance

5969 State Road 236

North Salem, Indiana

(800) 564-4088

Office Hours

MON – FRI

8 am – 5 pm

SAT – SUN

CLOSED

Drop Us a Line

Don’t be shy. Let us know if you have any questions!