Vomitoxin in the Corn: Call your agent or office immediately if you discover vitomoxin in your corn. If hauling directly to town, be sure to have the elevator hold a sample if the load has vomitoxin with level 5.1 parts per million or higher. A notice of loss must be submitted to be eligible for a quality loss. Elevator samples must be picked up by an adjuster.

Our News & Events

What is Crop Insurance? Do You Need it?

Crop insurance offers support to farmers in the face of threats of natural climatic phenomena, pests, and uncontrollable diseases. Crop insurance brings relief and compensates for the direct and immediate loss suffered by the insured crop, due to the risks covered under the policy.

What is Crop Insurance?

Crop insurance is a necessity for farmers. Commercial property or farm insurance policies do not cover the loss of crops. There are two different kinds of crop insurance:

Multiple Peril Crop Insurance—This insurance is a federally backed program and is a comprehensive insurance package for large and small businesses. It is the most common type of crop insurance, protecting farmers from crop yield losses by permitting farmers to insure a percentage of their historical crop production.

A multiple peril policy covers crop yields lost due to disease, drought, freeze, or other natural disasters. It’s important to know that farmers must purchase a policy before the crops are planted.

These multi-peril crop insurance policies exist to protect a farmer against property and liability risks without having to purchase a bunch of separate policies.

Crop-Hail Insurance—This insurance is sold by private insurers like us, Wathen Insurance, and not offered through a federal program. It specifically covers crops in the event of damage by hail or fires. Indiana has more than its share of hail-related weather.

Most policies not only protect crops from physical damage from hail, but they also safeguard farmers against vandalism, lightning, and other problems that exist during the transfer and storage of crops.

These policies are purchased by farmers to protect crops that have not yet been harvested. Crop-hail insurance can be purchased at any time during the growing season.

Crop-hail insurance policies typically provide protection up to the actual value of your crop. Additionally, farmers can increase coverage during a growing season. Wathen Insurance has a variety of coverages available. We can help create a package specific to your needs.

Did you know that crop-hail insurance is the oldest form of crop insurance, dating back many decades?

The History of Crop Insurance

Part of the USDA, the Federal Crop Insurance Program (FCIP) is a partnership between insurers and the federal government, founded in 1938. Not many farmers could afford the rates back then, and for nearly five decades, the FCIP was deteriorated and disused.

In the 1980s, the program was made more affordable and accessible to all farmers. Participation remained low until the 1990s when subsidy levels were increased and with the 2000s came a broadened range of products available to farmers.

Now, over 80 years later, the FCIPinsures 83% of crop acreage, insuring over 311 million acres.

What is Revenue Insurance?

Revenue Protection Crop Insurance is insurance against a poor crop yield. This type of insurance protects farmers in the event that revenue is lost due to low crop yields, low prices, or a combination of both. More than 75% of FCIP users have a revenue protection policy.

This additional protection was developed to aid farmers who raise cattle, cows, pigs, poultry, or other animals. If a natural disaster takes out your feed production, revenue insurance will help you.

Do you have more questions about crop insurance? Let us help. We pride ourselves on giving our customer peace of mind. Give Wathen Insurance a call at 765-676-9666, and we’d be happy to answer your questions or guide you through our available crop insurance policies.

Cover Crops for Soil Conservation

The cultivation of vegetables is an intensive production system that extracts large quantities of nutrients from the soil. The use of cover crops is a sustainable method to restore soil quality. In a 2016 survey by the Conservation Technology Information Center (CTIC), it was proven that cover crops increased corn yields by nearly 2% and soybean yields increased to almost 3%.

In general, cover crops are not harvested to be marketed, but to sustainably improve the results obtained from crops for commercial and soil purposes.

Most farmers would like to avoid long periods of rest with fallow land to restore soil nutrients, and rotation with cover crops is an option that allows maximum production of vegetables while improving soil quality.

Benefits of Cover Crops

Cover crops can be used to prevent soil erosion, improve soil quality, and prevent nutrient leaching, among other benefits. Each farmer determines the benefit they want to achieve, depending on their needs.

- Protect the soil against erosion. Soils in arid climates often contain high levels of ductile sand and silt particles that contribute to erosion caused by wind and water.

- Cover crops control the weeds.

- They control the leaching of nutrients. Cover crops can protect the environment from nitrate leaching by trapping residual nutrients left in the soil after harvesting the crop that will be marketed and recycling them for the next crop.

- They increase the population of microorganisms in the soil. Cover crops can improve biodiversity, increase the population of microorganisms that inhabit the land, and build a more flexible and stable system that ensures long-term productivity.

- Certain species of cover crops are more effective than others to maintain the integrity of the topsoil. The cover crop prevents erosion, reduces soil compaction, adds organic matter, and increases water filtration.

Types of Cover Crops

There are many options for farmers in terms of the types of cover crops they can use. You’ll have to decide which is best for you based on the crops you are planting in the future. Ask yourself these questions:

- Does it require adding nutrients, avoid the leaching of nutrients, improve soil structure, or alleviate pest problems?

- How does the crop behave with the current tillage and cultivation practices?

- What types of insecticides and herbicides are you using?

The quantity and availability of nitrogen obtained from a cover crop will vary greatly.

Plants can only absorb nitrogen in the form of nitrate, which has a lot of mobility in the soil. Rain and water movement in the soil can cause nitrate to move deeper, away from the roots of crops.

You’ll need to determine the water patterns in your soils and the probability of leaching nutrients, before planting the crop for commercial purposes. Some examples of cover crops include clover (red, giant, sweet, crimson), hairy vetch, winter pea, cowpea, alfalfa, and soybeans.

A non-legume plant such as rye, annual Ballico grass, oats, wheat, Sudangrass grass, and buckwheat, do not fix their own nitrogen. These types of cover crops are excellent for absorbing excess nutrients in the soil, producing biomass in the plants and improving the topsoil.

The type of protection crop is important, since its type depends on the management of pests, the sowing dates, and the rotations of the different crops.

Careful management of the different types of cover crops requires you to remain vigilant against pests, both weeds and insects. Sensibly select and manage cover crops so as not to allow viable seeds to be produced from a crop that can become weeds in the future.

Finally, it is important to remember that the use of cover crops offers producers a clear advantage in increasing soil quality. While you take steps to protect your soil, Wathen Insurance is here to help you protect your profits. Call us today at 765-676-9666.

SEO TitleCover Crops for Soil Conservation

Focus keyword:

Local Produce Growing in Indiana

If you aren’t growing produce yet, now might be the perfect time to consider it. Large grocery chains, restaurants, and local markets are all seeking fresh, local produce, a trend that is expected to last for many years to come.

How to Transition to Local Produce Growing

If you aren’t a produce farmer yet, there’s still time. Take Michigander Stephen Basore of Basore Farms who left the state of Florida to begin growing produce in Michigan. He spent his first year learning all about crops and the market, and not actually selling anything.

A few of his tips from his year of learning are:

- Know your options.By understanding your crop options based on growing conditions, you’ll have higher quality crops and bigger yields.

- Understand growing conditions.Before produce growing, Basore’s team focused on three things: irrigation, fertility, and crop timing. Plants will grow, behave, and thrive (or not thrive) differently for everyone.

- Do your own research.Thorough research was part of the winning game plan in Basore’s playbook. He reached out to local experts who knew all about irrigation, fertility, and the growing number of new technologies designed to help farmers.

- Be brave and stay curious.Always ask questions, especially of the people who understand the terrain. Don’t be afraid to reach out to others. You’ll need an exhaustive understanding of your state’s food safety and labor issues, which is the next item to tackle on Basore’s list.

Here is Why R&D Will Pay Off

It may seem crazy that Basore didn’t focus any energy on actually growing fruits or vegetables his first year, but there’s a good reason for that.

Take heirloom tomatoes for example. Indiana soil is prime for tomatoes, but beware; they can be tricky to grow. This is why proper research and development can save you time and money.

Heirloom tomatoes typically produce lower yields while requiring more labor. Of the tomatoes that do grow, the heirloom varieties are not as disease resistant as their newer counterparts.

Preventing disease is the number one problem with commercial production of the tomatoes because if part of the crop dies due to illness, the remaining tomatoes will be less flavorful.

By researching and learning about how to graft heirloom tomatoes, you can increase your yields by nearly 50% because the grafting reduces the risk of disease.

You’ll also learn that:

- Diseases that can wreck heirloom tomato crops thrive in moist conditions, so it’s beneficial to grow them where their foliage can stay dry.

- They need extra space for air circulation. The additional airflow will also help prevent or reduce disease.

- Get ready to prune. Heirloom tomatoes need extra care in pruning because they are strong growers. Pruning will allow higher production of the fruit at the top of the plant, and it allows for additional air circulation which will help prevent disease.

- You have to be careful not to overwater the crops because heirloom tomatoes have thin skin, prone to splitting.

Although this isn’t an exhaustive list of best methods in growing heirloom tomatoes, it does highlight the fact that R&D is as crucial as the physical act of planting itself. Restaurants and grocery stores want to shop for local produce, so now is the time to invest your time into local produce growing.

And, when you’re ready, give us a call at 765-676-9666. Wathen Insurance will protect your profits from all the crops you grow.

Prevented Planting

We know it has been a wet spring, and with that thought in mind, we wanted to provide the answers for our clients to some frequently asked questions regarding crops with prevented planting coverage.

Client FAQs

- There are pretty strict limitations on PP acreage as far as trying to get other value out of those acres. If you want to preserve your full PP payment, it’s black dirt or cover crop only.

- If you plant a second crop during the LPP of the PP crop there is NO PP payment.

- If you plant a second crop after the LPP of the PP crop, the PP payment is reduced to 35% of what it would have been. Exceptions to this rule may apply for producers in a double crop area, who have a history of double cropping.

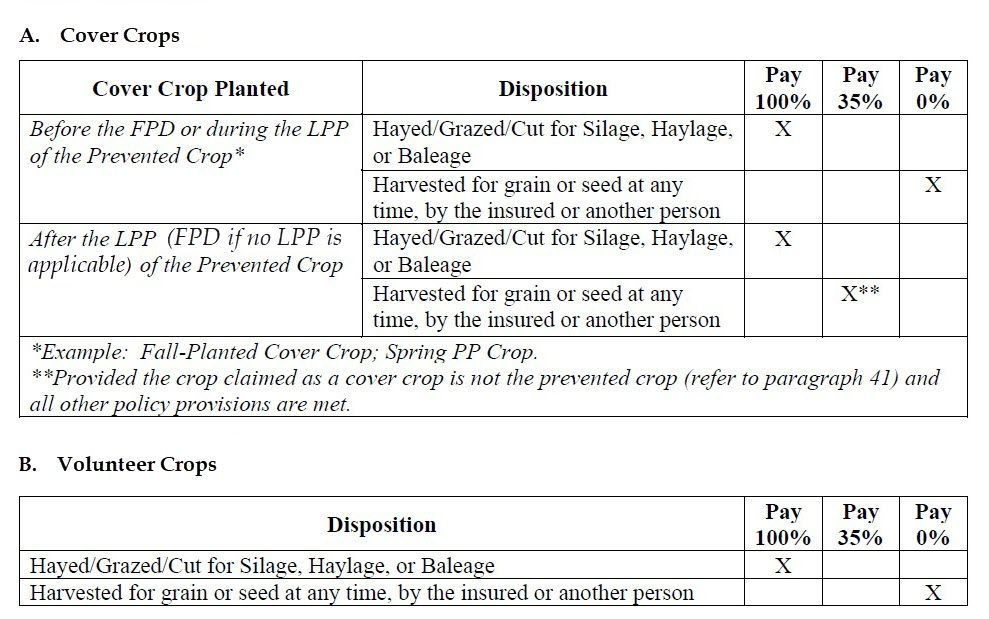

Can I plant a cover crop on the PP acres?

Cover crops may be planted and may be hayed, grazed, cut for silage, haylage, or baleage at any time without impacting the PP payment. However, cover crops cannot be harvested for grain or seed without impacting any potential PP payment. Please note that Corn will not be considered a cover crop on PP acreage. See table below to see how cover crops or volunteer crops may impact PP payments.

Can I rent my PP acreage to my neighbor who wants to plant a cover crop to hay/graze/cut for silage, haylage, or baleage?

Yes. Beginning with 2022 spring crops, it’s now okay to rent to your neighbor for those purposes. Keep in mind, though, that they cannot harvest for grain or seed without impacting any PP payment.

Will my APH database be impacted when I claim and qualify for a PP payment?

The APH database will suffer a yield reduction, but only on acreage where the payment was reduced to 35% because a second crop was planted. Those are the only PP acres that will show in the database and the yield they receive is 60% of the approved yield. PP acreage paid at 100% of the PP guarantee does not impact the APH database at all.

The Back 40 Call

Join the monthly webinar for insider ADM marketing insights on the 4th Tuesday of every month and an opportunity for Question & Answer with ADM Crop Risk Specialists.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

The Importance of Your Farm Maintenance

Is your farm winterized? Do you have a safety checklist or a maintenance schedule? If not, here are some reasons you should. Farm Maintenance and a Contingency Plan No one wants to think about the risks associated with managing a farm, its crops, and its...

Farm Bill Programs

2021 Information

2022 updates coming soon!

Our Story

The Wathen Family Agency

Wathen Insurance was started in the fall of 1982 by Tom and Joyce Wathen. While running a corn and soybean farming operation themselves, the opportunity to help other producers with their risk management decisions was very intriguing and appealing to Tom and Joyce. With a great deal of Passion and genuine interest in their policyholders the Wathen agency grew beyond their expectations, which provided the next generation of the Wathen’s an opportunity to join the business.

Keeping the business in the family provides for excellent quality control while affording attention to detail. We look forward to providing personalized service for our customers in the pursuit of continued success and who knows maybe our next generation will build upon what we started. Thanking you all for our continued success and wishing you a most prosperous year!

Federal Programs

Margin Protection Program

Margin Protection is a crop insurance coverage option that provides producers with coverage against an unexpected decrease in their operating margin caused by: Reduced county yields Reduced commodity prices Increased price of selected inputs Any combination of the…

PRF Program

PASTURE, RANGELAND, FORAGE The Risk Management Agency (RMA) Pasture, Rangeland, and Forage (PRF) Pilot Insurance Program is designed to provide insurance coverage on your perennial pasture, rangeland, or forage acres. This innovative pilot program is based on…

Area Yield Protection

Area Yield Protection (AYP) is designed as a risk management tool to insure against widespread loss of production of the insured crop in a county. AYP is primarily intended for use by those producers whose farm yield tend to follow the average County Yield. AYP is…

Area Revenue Protection

Area Revenue Protection covers against loss of yield due to county production loss and loss of revenue due to a county level production loss, price decline, or combination of both.

Yield Protection

Yield Protection (YP) and Actual Production History (APH) are multiple-peril crop insurance products that provide protection against losses in yield due to nearly all natural disasters.

Revenue Protection

Revenue Protection (RP) and Revenue Protection with Harvest Price Exclusion (RPHPE) are multiple-peril crop insurance products that are based on the Commodity Exchange Price Provisions (CEPP) prices and protects against production loss, price decline or increase, or a combination of both.

Supplemental Coverage Option

The Supplemental Coverage Option (SCO) is a county-level revenue-based or yield-based optional endorsement that covers a portion of losses not covered by the same crop’s underlying crop insurance policy.

Enhanced Coverage Option

Similar to the Supplemental Coverage Option (SCO), the Enhanced Coverage Option (ECO) is a new crop insurance option that provides additional area-based coverage for a portion of the underlying crop insurance policy deductible.

Livestock Risk Protection (LRP)

Livestock Risk Protection is designed to protect against declining market prices. A variety of coverage levels and insurance periods are offered that match the time the livestock would normally be marketed.

Livestock Gross Margin (LGM)

Livestock Gross Margin Insurance provides protection against the loss of gross margin (market value of livestock, or livestock products, minus feed costs). LGM uses futures prices to determine the expected gross margin and the actual gross margin. The price a producer actually receives at market is not used in these calculations.

Private Programs

Wind

Wind with Extra Harvest Allowance is an optional Crop Hail endorsement that provides coverage for wind, green snap, and extra harvest expense for corn that has blown down due to wind damage. It covers ears that cannot be recovered because of flattening, bending, or breaking of the stalk.

Band Coverage

At its core, BAND Coverage is a risk management tool that protects against shallow losses and provides reliable input cost recovery. A lower deductible translates to a higher trigger for the producer’s indemnity, providing support exactly when it is needed.

Revenue Boost

Revenue Boost is a supplemental policy that pairs with most MPCI plans to provide higher coverage and protection to insureds. Want to protect more margin and build a stronger risk management plan? Ask your agent today about Revenue Boost.

Wathen Insurance

5969 State Road 236

North Salem, Indiana

(800) 564-4088

Office Hours

MON – FRI

8 am – 5 pm

SAT – SUN

CLOSED

Drop Us a Line

Don’t be shy. Let us know if you have any questions!