Vomitoxin in the Corn: Call your agent or office immediately if you discover vitomoxin in your corn. If hauling directly to town, be sure to have the elevator hold a sample if the load has vomitoxin with level 5.1 parts per million or higher. A notice of loss must be submitted to be eligible for a quality loss. Elevator samples must be picked up by an adjuster.

Our News & Events

The Thrill of New Technology in Farming

Technology in farming achieves sustainable results that allow for better productivity, higher crop yields, and healthier livestock. The best agricultural practices are required for the successful production of essential food crops.

As humanity evolves, everything is changing rapidly. The same goes for the structure of agriculture. Today farms work very differently than a few decades ago, mainly thanks to new technologies and tools for agriculture. These advanced precision robotics devices and systems allow farmers to be more profitable, efficient, safe, and environmentally friendly.

The Benefits of Technology in Farming

Thanks to technological advances, farmers no longer have to apply water, fertilizers, and pesticides evenly across whole fields. Now they can utilize their time more efficiently, even treating certain plants and specific areas with different application methods.

The benefits include:

- Higher crop productivity

- Reduction of chemical spills in rivers and groundwater

- Greater worker safety

- Decreased use of water, fertilizers, and pesticides, which in turn reduces food prices

In addition, robotic technologies allow monitoring and more reliable management of natural resources, such as air and water quality. It also gives producers more significant control over the production, processing, distribution, and storage of plants and animals, resulting in:

- Efficiency and lower prices

- Safer growing conditions and safer food

- Environmental and ecological impact reduction

Technology in farming has brought a wave of momentous changes in all areas like education, medicine, business, and the industrial world, among others. Agriculture hasn’t escaped the beneficial impact of this technological revolution, accompanied more and more by new applications that make it possible to offer major scientific discoveries for farmers to take advantage of.

- For example, biotechnology has been used throughout history by farmers who selectively breed plants and animals to cultivate the best of the best. This kind of technology in farming is also used to create disease-resistant crops, develop crops with higher yields, and grow plants with higher pest resistance.

- Farmers can now rely on machines that can cultivate and harvest efficiently and effectively, saving time in production and saving money by growing vast quantities in a short amount of time.

- Modern farmers can also feel safe and secure in crop management with crop insurance. Although new technology can predict inclement weather and weather patterns, floods, fires, and other meteorological conditions, emergencies could happen at any time. The importance of having peace of mind when it comes to your livelihood cannot be overstated.

- New technology in agriculture has also provided farmers with cooling facilities to keep perishable crops fresh during delivery. This prevents tons of food spoilage and waste, saving farmers money and time.

Let us give you and your family the peace of mind they deserve. Give Wathen Insurance a call at 765-676-9666 today.

Are you on Facebook? We are, too. Let’s be friends!

Around the Farm: Farm Innovations

Innovations in agriculture have intervened and helped farmers overcome the potentially adverse effects of extreme weather conditions and increased global demand for food. Technology and farm innovations bring confidence to farmers around the world through trailblazing techniques and devices designed to increase efficiency and create sustainable cultivation practices. Here are some examples.

- The Calf Bottle Holder

A farmer in Nemaha, Iowa, invented a unique and creative way to feed calves, helping his children get their chores done sooner. He used a chunk of an old privacy fence and connected lag bolts a quarter of an inch in from each side. Then, he attached it to a fence at an angle with pieces of 24-inch wood, so that the calves can get every bit of milk out of their bottles while other chores are being done.

- The Repurposed Forklift

This farm innovation is perfect for farmers who have back problems or who just need a break from hauling heavy objects up and down. A Wellington, Ohio farmer bought an old, unusable forklift, and repurposed it to use in his shop. He salvaged the forklift’s mast and installed it into his shop as a hydraulic elevator that can move up to 1,500 pounds.

After the mast of the forklift was removed and mounted to the shop floor, the farmer attached some overhead beams at the top of his shop. The hydraulic pump was then connected to an electric motor. A switch to activate the pump and the motor was then mounted on some protective sheet metal, covering the mast. He even added a safety switch that stops the pump immediately if an individual bar is lifted by an arm or other parts sticking out of the lift.

- Quick Clean-up

This farm innovation is for those who hate the clean-up process. A smart farmer in Page, North Dakota, coated his shop floor with an industrial epoxy coating that is fuel, oil, and heavy equipment resistant. He claims it makes the floor much easier to clean up, and it keeps the floor’s integrity intact when using heavy machinery.

- Boost Your Cell Service

A couple of innovative farmers from Edwardsport, Indiana, were tired of not having any cell service inside their shop’s metal walls. They installed a cell phone repeater into the ceiling of their main workshop and claim that it instantly cured their cell-service problem. A cell phone repeater, or booster as they’re sometimes called, can cost anywhere from $100-$300, but they believe it’s worth it.

- Painting Project Support

Have you ever had trouble with paint getting tacky and stuck into the lid of the can? A farmer from Northwood, Iowa created a farm innovation by cutting out a piece of cardboard slightly bigger than the rim of the can. Then, he cut a slot in the cardboard hole, just large enough that a paintbrush can easily go in and out. It keeps excess paint from collecting in the rim and provides a convenient spot to wipe off excess paint from the brush while you’re painting.

Have you created an innovative farm tool? We’d love to hear about it. Go to the Wathen Insurance Facebook page and tell us all about it!

5 Tips for Farm Equipment Maintenance

Heavy machinery, especially farm equipment, requires constant maintenance to be in good working order. If you don’t practice adequate preventive farm equipment maintenance, you could cause damage that puts not only a driver at risk but also the lives of those near the equipment. Additionally, breakdowns are more costly than you might think. When your equipment does not work, it affects your crops – and bottom line.

5 Tips for Farm Equipment Maintenance

- Make training a priority for everyone. If it’s likely that more than one person will be operating your farm equipment, everyone must be on the same page. Keep your drivers and farm hands trained with the best driving and control practices, along with the preventive maintenance measures. Likewise, the creation of a checklist for verification of the correct functioning of the equipment is essential.

Remember that large machinery such as a tractor or combine should be inspected after use. The regular review of your farm equipment should be based on user manuals.

- Add and check lubricant levels frequently. Lubrication is one of the most important farm equipment maintenance controls. Lubricants reduce friction around moving parts. Proper maintenance related to these types of fluids will extend the life of your agricultural machinery.

To check to see if you have enough lubricant, first look for signs of excess oil or accumulation of grease in the pistons. Check for leaks around the oil seals if the level is correct. Keep in mind that the lubricant levels should be appropriate according to your owner’s manuals.

- Look for signs of wear. Vibration, shock, high temperatures, friction, and time all contribute to the breakdown of parts in heavy machinery. The vibration can come from gears and belts that are out of alignment. The shock can come from accidents or a poor operator management technique. High temperatures come from prolonged use, friction, inadequate lubrication, and worn parts, among other reasons.

The passing of years affects many vital components of your machinery. Over time, belts will be reformed, seals will dry and crack, bolts will loosen, etc. If you discover signs of wear on any moving part, be sure to replace the necessary parts right away.

- Clean your farm equipment. There are lots of seals and filters inside your farm machinery that keep parts clean and free of contamination, allowing the vehicle to run smoothly. Inspect seals regularly to ensure they are in good condition. Don’t forget to change the filter regularly as well.

As for vents, these should be kept clean to avoid creating a vacuum in the cabin. This could attract contaminants to it. In addition, the electronic components of the cabin are susceptible to failure if they become contaminated.Finally, farm equipment maintenance relies on you keeping your machinery in a warehouse, shed, or barn. Exposure to wind and weather can lead to oxidation. If your farm equipment will be sitting and not getting any use for a while, make sure it’s properly covered to prevent rust.

- Develop a preventive and corrective maintenance program. Fluids, tires, and electrical systems are among the components that should be checked regularly for preventive maintenance.

Power transmissions have lots of moving parts and must be kept in tip-top shape. Gearboxes should be checked for lubrication, vibration, and damage to parts. Look for signs of wear and excessive friction on seals, gaskets, and bearings. Replace them if necessary. Check filters frequently. Lubricate gears often. Always monitor transmission components.

Equipment isn’t the only thing that affects your farm operation. Weather can be your friend or your foe. That’s why crop insurance is so very important.

If you’re interested in any of our insurance programs, or want to learn more, give Wathen Insurance a call at 765-676-9666. We are more than happy to help.

Prevented Planting

We know it has been a wet spring, and with that thought in mind, we wanted to provide the answers for our clients to some frequently asked questions regarding crops with prevented planting coverage.

Client FAQs

- There are pretty strict limitations on PP acreage as far as trying to get other value out of those acres. If you want to preserve your full PP payment, it’s black dirt or cover crop only.

- If you plant a second crop during the LPP of the PP crop there is NO PP payment.

- If you plant a second crop after the LPP of the PP crop, the PP payment is reduced to 35% of what it would have been. Exceptions to this rule may apply for producers in a double crop area, who have a history of double cropping.

Can I plant a cover crop on the PP acres?

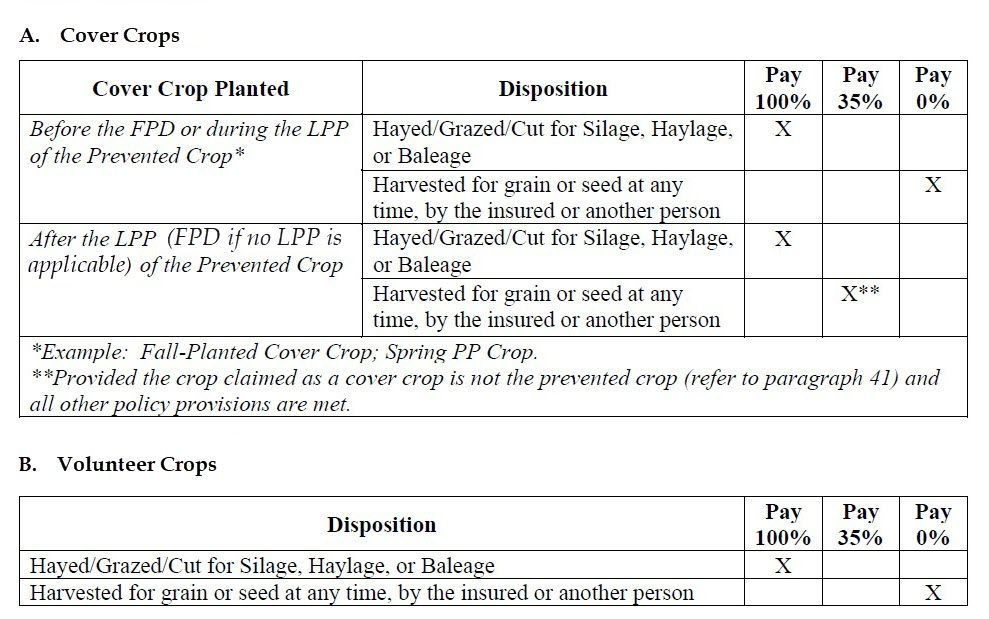

Cover crops may be planted and may be hayed, grazed, cut for silage, haylage, or baleage at any time without impacting the PP payment. However, cover crops cannot be harvested for grain or seed without impacting any potential PP payment. Please note that Corn will not be considered a cover crop on PP acreage. See table below to see how cover crops or volunteer crops may impact PP payments.

Can I rent my PP acreage to my neighbor who wants to plant a cover crop to hay/graze/cut for silage, haylage, or baleage?

Yes. Beginning with 2022 spring crops, it’s now okay to rent to your neighbor for those purposes. Keep in mind, though, that they cannot harvest for grain or seed without impacting any PP payment.

Will my APH database be impacted when I claim and qualify for a PP payment?

The APH database will suffer a yield reduction, but only on acreage where the payment was reduced to 35% because a second crop was planted. Those are the only PP acres that will show in the database and the yield they receive is 60% of the approved yield. PP acreage paid at 100% of the PP guarantee does not impact the APH database at all.

The Back 40 Call

Join the monthly webinar for insider ADM marketing insights on the 4th Tuesday of every month and an opportunity for Question & Answer with ADM Crop Risk Specialists.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Emergency Relief Program Phase Two Resources

ERP Phase Two Highlights What's Covered: ERP Phase Two payments cover crop losses to crops, trees, bushes, and vines for commodity and specialty crop producers affected by natural disasters including wildfires, droughts, hurricanes, winter storms, and more during...

Farm Bill Programs

2021 Information

2022 updates coming soon!

Our Story

The Wathen Family Agency

Wathen Insurance was started in the fall of 1982 by Tom and Joyce Wathen. While running a corn and soybean farming operation themselves, the opportunity to help other producers with their risk management decisions was very intriguing and appealing to Tom and Joyce. With a great deal of Passion and genuine interest in their policyholders the Wathen agency grew beyond their expectations, which provided the next generation of the Wathen’s an opportunity to join the business.

Keeping the business in the family provides for excellent quality control while affording attention to detail. We look forward to providing personalized service for our customers in the pursuit of continued success and who knows maybe our next generation will build upon what we started. Thanking you all for our continued success and wishing you a most prosperous year!

Federal Programs

Margin Protection Program

Margin Protection is a crop insurance coverage option that provides producers with coverage against an unexpected decrease in their operating margin caused by: Reduced county yields Reduced commodity prices Increased price of selected inputs Any combination of the…

PRF Program

PASTURE, RANGELAND, FORAGE The Risk Management Agency (RMA) Pasture, Rangeland, and Forage (PRF) Pilot Insurance Program is designed to provide insurance coverage on your perennial pasture, rangeland, or forage acres. This innovative pilot program is based on…

Area Yield Protection

Area Yield Protection (AYP) is designed as a risk management tool to insure against widespread loss of production of the insured crop in a county. AYP is primarily intended for use by those producers whose farm yield tend to follow the average County Yield. AYP is…

Area Revenue Protection

Area Revenue Protection covers against loss of yield due to county production loss and loss of revenue due to a county level production loss, price decline, or combination of both.

Yield Protection

Yield Protection (YP) and Actual Production History (APH) are multiple-peril crop insurance products that provide protection against losses in yield due to nearly all natural disasters.

Revenue Protection

Revenue Protection (RP) and Revenue Protection with Harvest Price Exclusion (RPHPE) are multiple-peril crop insurance products that are based on the Commodity Exchange Price Provisions (CEPP) prices and protects against production loss, price decline or increase, or a combination of both.

Supplemental Coverage Option

The Supplemental Coverage Option (SCO) is a county-level revenue-based or yield-based optional endorsement that covers a portion of losses not covered by the same crop’s underlying crop insurance policy.

Enhanced Coverage Option

Similar to the Supplemental Coverage Option (SCO), the Enhanced Coverage Option (ECO) is a new crop insurance option that provides additional area-based coverage for a portion of the underlying crop insurance policy deductible.

Livestock Risk Protection (LRP)

Livestock Risk Protection is designed to protect against declining market prices. A variety of coverage levels and insurance periods are offered that match the time the livestock would normally be marketed.

Livestock Gross Margin (LGM)

Livestock Gross Margin Insurance provides protection against the loss of gross margin (market value of livestock, or livestock products, minus feed costs). LGM uses futures prices to determine the expected gross margin and the actual gross margin. The price a producer actually receives at market is not used in these calculations.

Private Programs

Wind

Wind with Extra Harvest Allowance is an optional Crop Hail endorsement that provides coverage for wind, green snap, and extra harvest expense for corn that has blown down due to wind damage. It covers ears that cannot be recovered because of flattening, bending, or breaking of the stalk.

Band Coverage

At its core, BAND Coverage is a risk management tool that protects against shallow losses and provides reliable input cost recovery. A lower deductible translates to a higher trigger for the producer’s indemnity, providing support exactly when it is needed.

Revenue Boost

Revenue Boost is a supplemental policy that pairs with most MPCI plans to provide higher coverage and protection to insureds. Want to protect more margin and build a stronger risk management plan? Ask your agent today about Revenue Boost.

Wathen Insurance

5969 State Road 236

North Salem, Indiana

(800) 564-4088

Office Hours

MON – FRI

8 am – 5 pm

SAT – SUN

CLOSED

Drop Us a Line

Don’t be shy. Let us know if you have any questions!