Vomitoxin in the Corn: Call your agent or office immediately if you discover vitomoxin in your corn. If hauling directly to town, be sure to have the elevator hold a sample if the load has vomitoxin with level 5.1 parts per million or higher. A notice of loss must be submitted to be eligible for a quality loss. Elevator samples must be picked up by an adjuster.

Our News & Events

The Importance of Fairs for Farm Families

Most Midwest state fairs are canceled this year. Indiana, Ohio, Minnesota, Wisconsin, and more, have decided to call off or postpone their annual state fair this year due to health concerns. Many people are disappointed that they won’t be able to share this longstanding tradition with their farm families this summer.

Why Are Fairs Important?

As spring arrives, farm families look forward to and depend on upcoming fairs as the weather warms. Every year there are nearly 3,300 fairs taking place in North America, each one as important as the next. These small pieces of Americana mean more than French fries and funnel cakes (even though those are two very good reasons to get excited).

Celebration of Farm Families

Farm families are the backbone of rural communities, and the fair is a once-a-year opportunity to come together and celebrate all the hard work you’ve put into crops, livestock, crafts, food, and more. It’s a time to reflect and congratulate others on their hard work as well. Plus, it’s a great reason to kick back, relax, and be proud of your hard work throughout the year.

Economic Growth

Fairs are also vital because they help boost the economy of small communities. Many small business owners depend on the annual fair as their biggest chunk of income for the whole year. Canceled fairs, festivals, and shows mean no income. But for fairs that are being held locally, the economy booms, which is excellent news for small farm communities who are already facing many other hardships.

Education

Groups like Future Farmers of America (FFA) and 4-H look forward to showing off their work every year at the local fair. It’s a time to take part in a child’s education, and it’s the perfect opportunity to congratulate them on a job well done. After having so many positive experiences at the fair, kids are far more likely to continue on a farming education path by observing, learning, and honoring their achievements.

Coping with Cancelation

Because fairs are so important, and such a large part of farm families’ lives, coping with these widespread cancellations is difficult. People are losing money, children feel cheated and disappointed, and vendors are closing their businesses permanently.

Learning how to be a good farmer means knowing how to deal with catastrophes that are out of your control. Whether it’s a pandemic, drought, tornadoes, or hail, a farm family knows how to reduce their risk of damage and make the best decisions to keep crops and livestock healthy. The best way to do that is to be adequately insured and keeping everyone safe.

In 2020, it’s now more important than ever to have farm insurance, such as Area Revenue Protection and Margin Protection.Give Wathen Insurance a call at 765-676-9666 to see what we can do for you. We’re experts in crop and revenue insurance, and we’re just as disappointed as you are that we won’t be able to shake hands at this year’s state fair. But we can help you protect what’s yours with our personalized service and private programs.

Are you on Facebook? We are, too! Let’s be friends!

Advantages of Crop Rotation

Crop rotation is a technique used by farmers to keep soil enriched, or at least preventing it from being depleted from nutrients altogether. When done correctly, crop rotation also improves crop yields, reduces weeds, and decreases the pest population.

Other Advantages of Crop Rotation

Crop rotation has many crucial advantages to avoid problems for the farmer, such as pests. It can also save you time and money, as well as being environmentally friendly. Proper crop rotation prevents your soil from becoming depleted of nutrients since each type of plant requires different elements and brings nourishment to the land. Here’s how.

Prevent Pests and Diseases

One advantage of crop rotation is that you’ll prevent pests and diseases that attack from extending their stay. Most pests prefer certain crops over another, so a crop rotation over time creates land that is less likely to be infested. One pest can destroy an entire crop yield, so it’s important to consider crop insurance.

Pests and diseases tend to hibernate in the winter, so when it comes time to plant, soil conditions are perfect for them to thrive and continually reproduce. You’re basically gifting them an ideal home unless you change the type of crop you grow each season. Luckily, this also means savings in the use of pesticides, whether biological or chemical.

Reduce the Need for Pesticides

Pesticide poisoning is a contributing factor to the two million pesticide-related health issues reported every year. Crop rotation is a critical component in the reduction of these illnesses and essential for creating a sustainable future.

Reduced Pollution

Nitrogen added to fertilizers can end up in our drinking water and lead to the release of so much excess nitrogen that it disrupts the balance of fragile ecosystems. However, crop rotation gives your soil enough of everything it needs, naturally, so farmers don’t need to worry about the widespread contamination of land or water.

Save Water

Crop rotation helps you conserve water because you won’t have to irrigate your crops as often. With your improved soil structure, the soil naturally holds more water by absorbing more efficiently. This healthy soil also hangs onto the water deep down, so it stays moist especially in dry seasons. An additional benefit of less irrigation is the prevention of soil erosion.

Prevent Soil Erosion

Crop rotation prevents soil erosion. By planting the same crops year after year, your soil becomes more susceptible to erosion based on the shape of your plant’s root systems, shape, and canopy. Crop rotation prevents soil erosion by using cover crops to minimize exposure to the elements. Also, there’s reduced soil disturbance. More extended periods of undisturbed soil reduce its distress. Lastly, crop rotation prevents one of the most common causes of soil erosion, which is heavy rainfall. A soil structure with a good holding capacity will prevent soil erosion in the event of flooding. Crop insurance is absolutely essential when it comes to inclement weather, so make sure you’re covered.

Save Money

Crop rotation also has other indirect advantages such as reduced fertilizer use, which is a savings for organic farmers. Weeds are controlled more efficiently, which also means savings both in the economic aspect and in the time and dedication of the farmer.

Save Time

Did you know crop rotation can save you time by spreading your workload during planting season over a few weeks? Farmers who rotate crops don’t need to worry about the costly consequences of late planting that’s common with some crops, like corn.

Disadvantages of Crop Rotation

Crop rotation really only has one drawback (although some may see it as an advantage.) There is a crop rotation schedule that must be followed to reap such benefits. The crop rotation schedule has to be strict to optimize land and soil.

The rotation of crops consists of alternating harvests of different families and with different nutritional needs in the same place during different cycles, preventing the soil from being depleted from essential nutrients. This also prevents crop disease and weeds as well. This ensures the sustainability of the land by promoting crops that alternate year after year to maintain soil fertility.

You can plan and schedule a successful crop rotation with a little bit of advanced preparation. Give Wathen Insurance a call at 765-676-9666 to discuss crop insurance before the next harvest.

Are you on Facebook? We are, too! Let’s be friends!

Modern Farming Improves with Amazing Scientific Evolution

Modern farming has come a long way in the last few decades, primarily due to new technologies and scientific discoveries. Two centuries ago, 90 percent of Americans were farming their own land and growing their own food to eat. In the 1940s, one farmer could feed 19 people. Compare that to today’s farmer who feeds 155 people. This is because of modern farming and technological advances that have changed the impact farmers have on the world.

So, what’s changed?

Modern Farming Equipment

Farmers from long ago depended on horse-drawn equipment. They also did a lot of work by hand. Horses are not machines, nor are humans, which means there was only so much one farmer could do in one day. When you include recovery time for horses and humans, you understand how it could have taken them a very, very long time to grow food successfully. So, it makes sense that one farmer could only feed 19 people.

Today, you’re lucky enough to have modern farming equipment. Combines, plows, and tractors move quickly and can get through a lot in one day. Humans can work all day in the cab of a combine, plowing fields, without needing any time to recover. We’re also lucky enough to have insurance policies that protect farmers when something breakdowns and crops can’t be recovered. Modern farming practices have even improved livestock lifestyles.

Livestock

Even the way livestock are cared for has improved as modern farming proceeds. For example, research and science have shown farmers which kinds of housing work best for which types of animals to make them more comfortable and thrive in a humane setting. Science also lets farmers know about nutritional standards and what kinds of feed is best for their livestock. Take, for example, a cow. When a cow is more comfortable, with proper nutrition, a safe shelter, and soft bedding, she produces more milk.

While yields increase and animals are now more protected, the rise of technology in modern farming has led to a significant decrease in diseases like trichinosis in the pig population. When pigs weren’t housed in optimum shelters, they had a chance to encounter wild boars which would pass on the disease. Now that we know pigs in confinement are safer, we also keep the human population healthy.

Here’s a fun fact! In the 1940s, there were 400 reported cases of trichinosis in the US. In 2012 there were only 15. Wow!

Modern farming has come a long way through the use of technology and science to improve crop harvests and livestock yields. Sustainable agricultural practices in modern farming help us conserve, preserve, and protect our planet. Give Wathen Insurancea call at 765-676-9666 to discuss how we can help you protect your crops.

Are you on Facebook? We are, too! Let’s be friends!

Prevented Planting

We know it has been a wet spring, and with that thought in mind, we wanted to provide the answers for our clients to some frequently asked questions regarding crops with prevented planting coverage.

Client FAQs

- There are pretty strict limitations on PP acreage as far as trying to get other value out of those acres. If you want to preserve your full PP payment, it’s black dirt or cover crop only.

- If you plant a second crop during the LPP of the PP crop there is NO PP payment.

- If you plant a second crop after the LPP of the PP crop, the PP payment is reduced to 35% of what it would have been. Exceptions to this rule may apply for producers in a double crop area, who have a history of double cropping.

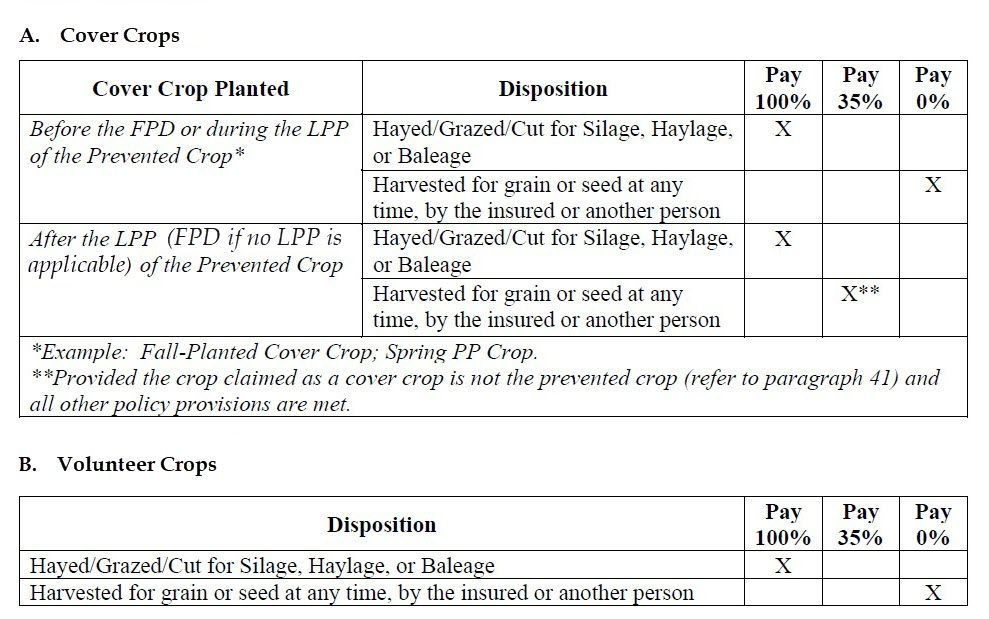

Can I plant a cover crop on the PP acres?

Cover crops may be planted and may be hayed, grazed, cut for silage, haylage, or baleage at any time without impacting the PP payment. However, cover crops cannot be harvested for grain or seed without impacting any potential PP payment. Please note that Corn will not be considered a cover crop on PP acreage. See table below to see how cover crops or volunteer crops may impact PP payments.

Can I rent my PP acreage to my neighbor who wants to plant a cover crop to hay/graze/cut for silage, haylage, or baleage?

Yes. Beginning with 2022 spring crops, it’s now okay to rent to your neighbor for those purposes. Keep in mind, though, that they cannot harvest for grain or seed without impacting any PP payment.

Will my APH database be impacted when I claim and qualify for a PP payment?

The APH database will suffer a yield reduction, but only on acreage where the payment was reduced to 35% because a second crop was planted. Those are the only PP acres that will show in the database and the yield they receive is 60% of the approved yield. PP acreage paid at 100% of the PP guarantee does not impact the APH database at all.

The Back 40 Call

Join the monthly webinar for insider ADM marketing insights on the 4th Tuesday of every month and an opportunity for Question & Answer with ADM Crop Risk Specialists.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Post-Application Coverage Endorsement

The PACE program provides insurance for conservation-minded corn farmers who split-apply nitrogen fertilizer. The Post-Application Coverage Endorsement is the latest result of the RMA’s recent efforts to reward conservation and sustainable farming among American...

Farm Bill Programs

2021 Information

2022 updates coming soon!

Our Story

The Wathen Family Agency

Wathen Insurance was started in the fall of 1982 by Tom and Joyce Wathen. While running a corn and soybean farming operation themselves, the opportunity to help other producers with their risk management decisions was very intriguing and appealing to Tom and Joyce. With a great deal of Passion and genuine interest in their policyholders the Wathen agency grew beyond their expectations, which provided the next generation of the Wathen’s an opportunity to join the business.

Keeping the business in the family provides for excellent quality control while affording attention to detail. We look forward to providing personalized service for our customers in the pursuit of continued success and who knows maybe our next generation will build upon what we started. Thanking you all for our continued success and wishing you a most prosperous year!

Federal Programs

Margin Protection Program

Margin Protection is a crop insurance coverage option that provides producers with coverage against an unexpected decrease in their operating margin caused by: Reduced county yields Reduced commodity prices Increased price of selected inputs Any combination of the…

PRF Program

PASTURE, RANGELAND, FORAGE The Risk Management Agency (RMA) Pasture, Rangeland, and Forage (PRF) Pilot Insurance Program is designed to provide insurance coverage on your perennial pasture, rangeland, or forage acres. This innovative pilot program is based on…

Area Yield Protection

Area Yield Protection (AYP) is designed as a risk management tool to insure against widespread loss of production of the insured crop in a county. AYP is primarily intended for use by those producers whose farm yield tend to follow the average County Yield. AYP is…

Area Revenue Protection

Area Revenue Protection covers against loss of yield due to county production loss and loss of revenue due to a county level production loss, price decline, or combination of both.

Yield Protection

Yield Protection (YP) and Actual Production History (APH) are multiple-peril crop insurance products that provide protection against losses in yield due to nearly all natural disasters.

Revenue Protection

Revenue Protection (RP) and Revenue Protection with Harvest Price Exclusion (RPHPE) are multiple-peril crop insurance products that are based on the Commodity Exchange Price Provisions (CEPP) prices and protects against production loss, price decline or increase, or a combination of both.

Supplemental Coverage Option

The Supplemental Coverage Option (SCO) is a county-level revenue-based or yield-based optional endorsement that covers a portion of losses not covered by the same crop’s underlying crop insurance policy.

Enhanced Coverage Option

Similar to the Supplemental Coverage Option (SCO), the Enhanced Coverage Option (ECO) is a new crop insurance option that provides additional area-based coverage for a portion of the underlying crop insurance policy deductible.

Livestock Risk Protection (LRP)

Livestock Risk Protection is designed to protect against declining market prices. A variety of coverage levels and insurance periods are offered that match the time the livestock would normally be marketed.

Livestock Gross Margin (LGM)

Livestock Gross Margin Insurance provides protection against the loss of gross margin (market value of livestock, or livestock products, minus feed costs). LGM uses futures prices to determine the expected gross margin and the actual gross margin. The price a producer actually receives at market is not used in these calculations.

Private Programs

Wind

Wind with Extra Harvest Allowance is an optional Crop Hail endorsement that provides coverage for wind, green snap, and extra harvest expense for corn that has blown down due to wind damage. It covers ears that cannot be recovered because of flattening, bending, or breaking of the stalk.

Band Coverage

At its core, BAND Coverage is a risk management tool that protects against shallow losses and provides reliable input cost recovery. A lower deductible translates to a higher trigger for the producer’s indemnity, providing support exactly when it is needed.

Revenue Boost

Revenue Boost is a supplemental policy that pairs with most MPCI plans to provide higher coverage and protection to insureds. Want to protect more margin and build a stronger risk management plan? Ask your agent today about Revenue Boost.

Wathen Insurance

5969 State Road 236

North Salem, Indiana

(800) 564-4088

Office Hours

MON – FRI

8 am – 5 pm

SAT – SUN

CLOSED

Drop Us a Line

Don’t be shy. Let us know if you have any questions!