Vomitoxin in the Corn: Call your agent or office immediately if you discover vitomoxin in your corn. If hauling directly to town, be sure to have the elevator hold a sample if the load has vomitoxin with level 5.1 parts per million or higher. A notice of loss must be submitted to be eligible for a quality loss. Elevator samples must be picked up by an adjuster.

Our News & Events

Crop Tissue Testing Can Save Your Farm

During times of uncertainty, whether it’s the weather or the economy, humans feel more positive when they have knowledge that puts them in the driver’s seat. Gaining control of a scary, unknown future situation helps you prep and plan. This is the exact reason that Wathen Insurance exists. We give families security and peace of mind that help them sleep at night with insurance programs that protect a precarious future in farming. And, that’s why crop tissue testing is something you should be doing on your farm.

What is Crop Tissue Testing?

Using diagnostic tools on your crops isn’t much different than a doctor diagnosing a patient. Plant tissue analysis is an underutilized and undervalued monitoring tool that you should take advantage of.

Crop tissue testing is calculating the nutrient content of a plant. Understanding if a crop is deficient in a particular nutrient could explain stunted growth or off-colored crops. One mistake farmers often make is taking tissue samples of only plants that look weak or of poor quality.

However, you should use this kind of investigative tool before plants begin looking less than their best. You want to know what you’re doing right as well as what needs improvement.

Take plant tissue samples from several areas and include healthy plants, and plants that look deficient. Because soil varies wildly across the landscape, you’ll be able to capture information that tells you how to get a successful uniform crop every season.

A crop tissue testing lab will show you the nutrient status of the following critical components of each plant:

- Nitrogen

- Boron

- Calcium

- Copper

- Sulfur

- Phosphorus

- Potassium

- Magnesium

- Sodium

- Iron

- Manganese

- Zinc

Why is Crop Tissue Testing Important?

Taking tissue samples of young plants help you get ahead of potential problems. This will allow you to make corrections at critical growth stages that optimize crop fertility. The more you understand about the nutrient content of a crop and its relationship to the soil and yield, the more robust your plants will be every year.

Agriculturists agree that crop tissue testing is valuable in order to:

- Recognize nutrient deficiencies, toxicity, and imbalances

- Foresee possible weaknesses in current or future crops

- Validate how effective your current fertility method is

- Forecast needs for various critical nutrients at crucial growth stages

- Assess nutrients to develop future budgets

- Verify the value of the crop as animal feed

- Accurately develop a succession or crop rotation plan

If you aren’t already familiar with crop tissue testing, seek advice from a specialist to get you started. They’ll know when, where, and how to properly handle and deliver samples to a lab, and they’ll also help you understand how to interpret the analytical results.

Once you understand the nutrient content of your crops, consider ensuring their safety and success with crop insurance. Give Wathen Insurance a call at 765-676-9666 to discuss your options.

Are you on Facebook? We are, too! Let’s be friends!

Farmers in the 19th Century: How Much has Really Changed?

Believe it or not, the art and the science of farming hasn’t changed much over the last century. Some things that have changed are selective breeding, the creation of pesticides and fertilizers, and the integration of modern machinery. Despite these improvements over the years, farmers still face some of the same hardships.

Expansion

During the early 19th century, farmers had to be flexible and diverse in their agricultural occupation. They raised lots of different animals, from chickens to pigs, from cattle to sheep. The expansion didn’t stop there. Farmers from long ago planted many different crops instead of focusing on one or two, and they didn’t consider crop rotation during that time. On 80 acres of land, a farmer planted wheat, oats, corn, barley, pumpkins, beans, radishes, and more.

As the 20th century neared, farm machinery was made widely available and affordable. Along with affordability, these new machines were innovative, allowing agricultural specialists to focus on only one or two crops, and perhaps only a few animals, while still earning adequate profit.

Education

Farmers were able to make more money by diversifying less, which means they had to learn new technologies as their farms and families grew. That hasn’t changed one bit from a century ago. Agricultural technology grows in leaps and bounds in an everchanging farm-dependent society. Therefore, farmers now have to keep up with education, business skills, and advanced technical knowledge of machinery. Just like farmers from long ago, present-day agriculturists must always be honing their skills.

Sustainability

Inheriting, building, or growing a farm successfully all depends upon sustainability, just as it has in decades past. For example, the agricultural industry is always changing and adapting as ecosystems transform, and climate change occurs. From small-scale, single-family farms, to huge farming giants, agricultural productivity all hinge upon a sustainable food systems model. Unlike farmers in the 19th century, though, the current challenges facing today’s farmers are much easier to mitigate and prevent.

Weather

Another consistent theme in farming throughout the centuries is out-of-control weather. Yes, it may be 2020, but we still can’t control tornados and tsunamis. Farmers today, just like the farmers in the 19th century, lose crops to drought, hail, and cold weather. However, luckily, agricultural specialists now rely on federal and private insurance programs to protect their livelihoods from lousy weather or loss of revenue.

Farmers in the 19th Century

The United States relies on today’s farmers, just as citizens did in the 19th century. Just like in the past, most farms are family-owned, passed down from generation to generation. We know just how hard farmers in the Midwest have to work to not only put food on their own tables, but they also strive to put food on the table of Americans across the land.

We understand your worries and concerns, from one family-owned business to another. Call Wathen Insurance today at 765-676-9666 to talk about all the ways we can ease your fears in today’s farming landscape.

Are you on Facebook? We are, too! Let’s be friends!

The Importance of Rural Internet Access

Rural internet access has never been more essential. Children need it for schoolwork, and farm families need it to run their agricultural businesses. Access to the internet also creates and molds entire communities. This critical contact promotes entrepreneurship, travel and tourism, and encourages new means and opportunities for remote workers.

Rural Internet Access for Your Farm Business

A speedy internet connection is necessary to carry out different activities, both personal and professional. As we move through 2020, both small and large businesses are finding the benefits of internet access more and more appealing. Of course, the internet isn’t the only way to interact in rural areas, but it is an indispensable tool to connect with everything the world has to offer.

According to an updated broadband report, almost 88% of the population in Indiana has a fast broadband connection. Additionally, 96% of Hoosiers have access to wired internet service. These statistics are promising, given that so much of Indiana is made up of rural farming communities.

Having high-quality internet access is just as important. Even for those with access, the quality of service is often poor, limiting their potential to take full advantage of the latest technologies for their farm business, and making it difficult to bridge the digital divide. Simply put, a farm business needs reliable rural internet access to succeed in today’s world.

Rural Internet Access for Education

The necessity of rural internet access doesn’t stop with the family business. Kids and young adults attending college must have fast internet in order to complete schoolwork, get good grades, and graduate. Slow internet speeds in rural Indiana communities can create a load of problems.

What does having a slower download speed mean in practice? Assuming that students have access at a speed of 5 Mbps, this allows them to send emails, surf the internet, and use online payment applications. At this speed, however, students and teachers won’t be able to connect to conduct video conferencing or HD video streaming, which requires speeds five times faster.

Unfortunately, the lowest download speeds are found in the most vulnerable communities, including the poorest urban sectors, small rural towns, and in particular, women living in rural areas, distancing these populations even further from opportunities in the digital classroom.

One Less Thing to Worry About

At Wathen Insurance, we want to take some worries off your plate. We know how hard our fellow Hoosiers work online and in the fields and it’d be a shame for all the hard work to go to waste. Consider our private or federal programs to protect your business and your family. We’re here to provide security and support on-going operations during this challenging time.

Don’t wait another day. Call Wathen Insurance at 765-676-9666 to discuss the best plan for you.

Are you on Facebook? We are, too! Let’s be friends!

Prevented Planting

We know it has been a wet spring, and with that thought in mind, we wanted to provide the answers for our clients to some frequently asked questions regarding crops with prevented planting coverage.

Client FAQs

- There are pretty strict limitations on PP acreage as far as trying to get other value out of those acres. If you want to preserve your full PP payment, it’s black dirt or cover crop only.

- If you plant a second crop during the LPP of the PP crop there is NO PP payment.

- If you plant a second crop after the LPP of the PP crop, the PP payment is reduced to 35% of what it would have been. Exceptions to this rule may apply for producers in a double crop area, who have a history of double cropping.

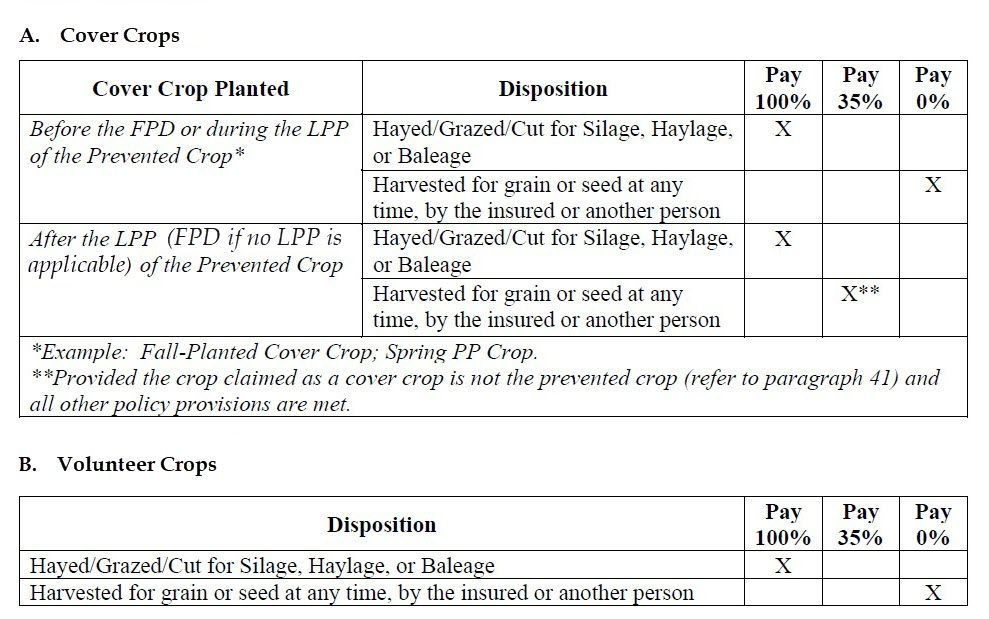

Can I plant a cover crop on the PP acres?

Cover crops may be planted and may be hayed, grazed, cut for silage, haylage, or baleage at any time without impacting the PP payment. However, cover crops cannot be harvested for grain or seed without impacting any potential PP payment. Please note that Corn will not be considered a cover crop on PP acreage. See table below to see how cover crops or volunteer crops may impact PP payments.

Can I rent my PP acreage to my neighbor who wants to plant a cover crop to hay/graze/cut for silage, haylage, or baleage?

Yes. Beginning with 2022 spring crops, it’s now okay to rent to your neighbor for those purposes. Keep in mind, though, that they cannot harvest for grain or seed without impacting any PP payment.

Will my APH database be impacted when I claim and qualify for a PP payment?

The APH database will suffer a yield reduction, but only on acreage where the payment was reduced to 35% because a second crop was planted. Those are the only PP acres that will show in the database and the yield they receive is 60% of the approved yield. PP acreage paid at 100% of the PP guarantee does not impact the APH database at all.

The Back 40 Call

Join the monthly webinar for insider ADM marketing insights on the 4th Tuesday of every month and an opportunity for Question & Answer with ADM Crop Risk Specialists.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Ag Education in Indiana’s High Schools May be Negatively Impacted by Budget Bill

As your Indiana lawmakers put together a budget bill to fund the state for the next two years, that bill in its current form may end up having a negative impact on ag education in Indiana’s high schools. Indiana Senate recently revised House Bill 1001 to eliminate...

Farm Bill Programs

2021 Information

2022 updates coming soon!

Our Story

The Wathen Family Agency

Wathen Insurance was started in the fall of 1982 by Tom and Joyce Wathen. While running a corn and soybean farming operation themselves, the opportunity to help other producers with their risk management decisions was very intriguing and appealing to Tom and Joyce. With a great deal of Passion and genuine interest in their policyholders the Wathen agency grew beyond their expectations, which provided the next generation of the Wathen’s an opportunity to join the business.

Keeping the business in the family provides for excellent quality control while affording attention to detail. We look forward to providing personalized service for our customers in the pursuit of continued success and who knows maybe our next generation will build upon what we started. Thanking you all for our continued success and wishing you a most prosperous year!

Federal Programs

Margin Protection Program

Margin Protection is a crop insurance coverage option that provides producers with coverage against an unexpected decrease in their operating margin caused by: Reduced county yields Reduced commodity prices Increased price of selected inputs Any combination of the…

PRF Program

PASTURE, RANGELAND, FORAGE The Risk Management Agency (RMA) Pasture, Rangeland, and Forage (PRF) Pilot Insurance Program is designed to provide insurance coverage on your perennial pasture, rangeland, or forage acres. This innovative pilot program is based on…

Area Yield Protection

Area Yield Protection (AYP) is designed as a risk management tool to insure against widespread loss of production of the insured crop in a county. AYP is primarily intended for use by those producers whose farm yield tend to follow the average County Yield. AYP is…

Area Revenue Protection

Area Revenue Protection covers against loss of yield due to county production loss and loss of revenue due to a county level production loss, price decline, or combination of both.

Yield Protection

Yield Protection (YP) and Actual Production History (APH) are multiple-peril crop insurance products that provide protection against losses in yield due to nearly all natural disasters.

Revenue Protection

Revenue Protection (RP) and Revenue Protection with Harvest Price Exclusion (RPHPE) are multiple-peril crop insurance products that are based on the Commodity Exchange Price Provisions (CEPP) prices and protects against production loss, price decline or increase, or a combination of both.

Supplemental Coverage Option

The Supplemental Coverage Option (SCO) is a county-level revenue-based or yield-based optional endorsement that covers a portion of losses not covered by the same crop’s underlying crop insurance policy.

Enhanced Coverage Option

Similar to the Supplemental Coverage Option (SCO), the Enhanced Coverage Option (ECO) is a new crop insurance option that provides additional area-based coverage for a portion of the underlying crop insurance policy deductible.

Livestock Risk Protection (LRP)

Livestock Risk Protection is designed to protect against declining market prices. A variety of coverage levels and insurance periods are offered that match the time the livestock would normally be marketed.

Livestock Gross Margin (LGM)

Livestock Gross Margin Insurance provides protection against the loss of gross margin (market value of livestock, or livestock products, minus feed costs). LGM uses futures prices to determine the expected gross margin and the actual gross margin. The price a producer actually receives at market is not used in these calculations.

Private Programs

Wind

Wind with Extra Harvest Allowance is an optional Crop Hail endorsement that provides coverage for wind, green snap, and extra harvest expense for corn that has blown down due to wind damage. It covers ears that cannot be recovered because of flattening, bending, or breaking of the stalk.

Band Coverage

At its core, BAND Coverage is a risk management tool that protects against shallow losses and provides reliable input cost recovery. A lower deductible translates to a higher trigger for the producer’s indemnity, providing support exactly when it is needed.

Revenue Boost

Revenue Boost is a supplemental policy that pairs with most MPCI plans to provide higher coverage and protection to insureds. Want to protect more margin and build a stronger risk management plan? Ask your agent today about Revenue Boost.

Wathen Insurance

5969 State Road 236

North Salem, Indiana

(800) 564-4088

Office Hours

MON – FRI

8 am – 5 pm

SAT – SUN

CLOSED

Drop Us a Line

Don’t be shy. Let us know if you have any questions!